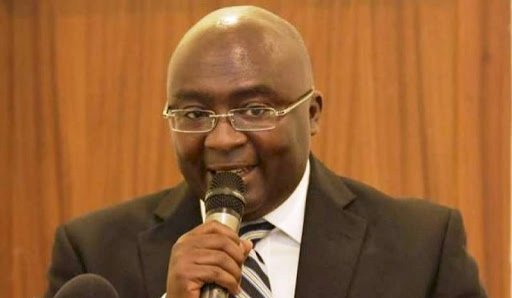

We Saved 4.6 Million Ghanaian Depositors With Financial Sector Cleanup - Bawumia

The Vice President, Dr. Mahamudu Bawumia says over four million depositors would have completely lost their funds had the financial sector cleanup not been undertaken. According to him, the erstwhile Mahama’s government’s poor administration of the economy put

the country’s financial sector on the verge of collapse but through the intervention of the current government, the monies of depositors were saved. He further disclosed that the clean up cost the country GHS21 billion. “We were on the brink of losing deposits of 4.6

million Ghanaians and that’s why we implemented the rescue plan and you had to essentially rationalize the banking system and make sure that the deposits were saved. So those deposits were saved and government has had to expend close to GHS21 billion in financial

sector to save these depositors.” Dr. Bawumia also indicated that the Receiver will start payment of depositors who had their monies locked up with Savings and Loan companies following the financial sector clean up. “I’m happy to say that so far, as of

yesterday, I am informed that liquidity has now been raised to take care of all the Savings and Loans and the microfinance companies. So I think that the Receiver is going to go ahead this week to make payments to these groups,” he further added. He made this known in an interview on Peace FM on Tuesday, August 25, 2020.

Banking sector reforms

The financial sector cleanup commenced by the Akufo Addo administration in August 2017 led to the collapse of nine universal banks, 347 microfinance companies, 39 microcredit companies or money lenders, 15 savings and loans companies, eight finance house companies,

and two non bank financial institutions.” The Securities and Exchange Commission also announced the revocation of licenses of 53 Fund Management Companies. The total estimated cost of the state’s fiscal intervention, excluding interest payments, from 2017 to 2019 was pegged at GHS16.4 billion. The collapse of the institutions left clients in distress as many of the customers have been struggling to retrieve their savings and investments.